Showing income calculator for Australia

Net income per Year:

Net income per Month:

Full Guide To Taxes In Japan

Looking for a quick way to understand taxes in Japan? Wondering how much can you earn in Japan (after-tax)? Here I tell you all about it!

Taxes in Japan are paid on several grounds – income tax, enterprise tax (paid by self-employed people), property tax (paid by the owners of land and properties), consumption tax (similar to VAT, and it is paid on consumers goods), vehicle tax (a tax burden for people who own cars), liquor, tobacco, and gasoline tax.

- Employment Income (individual’s income tax): This includes salaries, bonuses, allowances, and other compensation received from employment. Employers are responsible for withholding income tax from employees’ salaries through a system called “Withholding Income Tax.”

- Business Income: Individuals engaged in business activities, including freelancers and self-employed professionals, are required to report their business income. Deductions for business-related expenses are allowed to calculate the taxable amount.

- Capital Gains: Capital gains from the sale of real estate and financial assets are subject to taxation. However, certain exemptions and deductions may apply, depending on the nature and duration of the investment.

- Rental Income: Income derived from renting out properties is taxable in Japan. Deductions for expenses related to property maintenance and management can be applied to reduce taxable income.

Tax Payers In Japan

People pay income tax on their taxable income per year. The taxpayer’s residence status and annual income determine the amount of taxes she pays.

The tax system in Japan identifies three different categories for tax payment.

1) Non-residents – People who have lived in Japan for less than 1 year and do not have a primary base in Japan (short stay) belong to this group. This group pays taxes only on the annual income earned in Japan.

2) Non-permanent residents – Citizens who have lived in Japan for less than 5 years and do not intend to stay permanently in Japan make up this class. The income tax for this group includes tax from all income (from Japan and abroad), except income from abroad that is not sent to Japan.

3) Permanent residents – Individuals residing in Japan for at least 5 years with the intention of staying permanently in Japan fall into this group. Equivalent to Japanese nationals, this group’s tax payment includes all income from both Japan and outside Japan.

An employer usually pays income tax from the gross salary of an employee, and it is common for the employee not to have to file income tax returns, as these are already paid (subject to withholding tax).

According to the Japanese tax system, an employee must file a tax return if one of the following conditions applies:

- If the employee leaves Japan before the end of the tax year

- If the employer does not withhold taxes

- If there are multiple employers

- If the total income per year is greater than 40,000,000 JPY per year or a side income greater than 400,000 JPY

If you are a taxpayer in Japan, you must file your income tax return between the 16th of February and the 15th of March of the current year for the previous tax year.

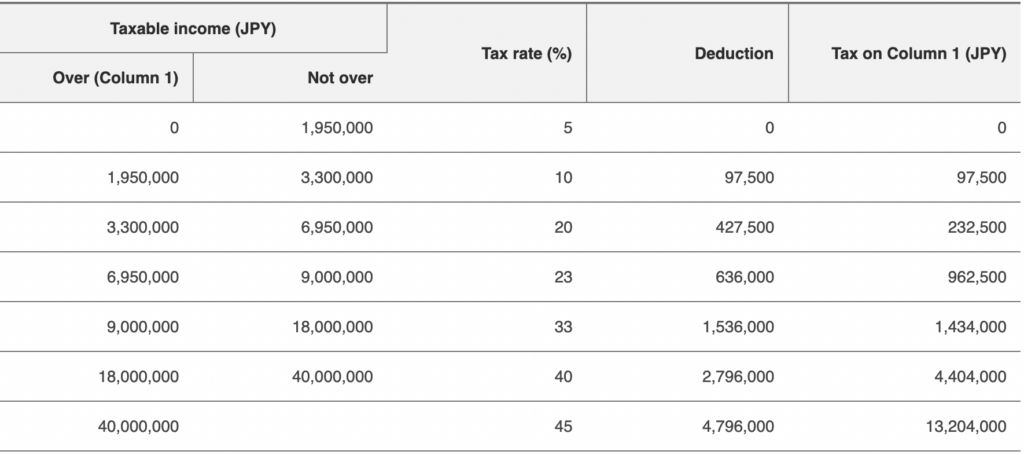

Japan Income Tax Rates

Japan employs a progressive tax rate system for personal income tax, with rates ranging from 5% to 45%.

The rates apply to different income brackets, and certain deductions and credits are available to reduce the tax burden.

Japan income tax calculator

Our free calculator provides a good estimate on the income tax calculations for all taxpayers. To calculate your net income, just slide from left to right to adjust your GROSS income per year.

At the bottom of the table, you will immediately see your NET monthly and NET yearly income — basically what ends in your pocket.

Please note that the calculator provides an estimate of your tax calculations on a best-efforts basis and can be under no circumstances taken to derive any rights.

Click here to check out Singapore as it might be even more attractive for earnings.

Austria

Austria Belgium

Belgium Croatia

Croatia Cyprus

Cyprus Czech Republic

Czech Republic Denmark

Denmark Estonia

Estonia Finland

Finland France

France Germany

Germany Ireland

Ireland Luxembourg

Luxembourg Norway

Norway Poland

Poland Portugal

Portugal Spain

Spain Sweden

Sweden The Netherlands

The Netherlands The United Kingdom

The United Kingdom Australia

Australia New Zealand

New Zealand Canada

Canada United States

United States Japan

Japan Singapore

Singapore

Leave a Reply